THE IMPACT OF EXCHANGE RATE VOLATILITY ON SELECTED MACROECONOMIC VARIABLES IN NIGERIA

ABSTRACT

Fluctuation in exchange rate has been a recognized catalyst that brings about change in other macroeconomic indicators. This phenomenon was underscored by series of mechanisms through which economic activities of a given country reflect on its exchange rate to other international currencies. In order to assess the empirical influence of rising fluctuation in exchange rate, this study focused on the impact of exchange rate volatility (EXV) on selected macroeconomic variables in Nigeria which included gross domestic product (GDP), foreign direct investment inflow (FDI), index of trade openness (TOP) and inflation rate (INF). The Autoregressive Distributed Lag model (ARDL) and Vector Error Correction Model (VECM) were used in the study. Annual time series data from 1981 to 2015 were obtained from the Central Bank of Nigeria Statistics Bulletin 2015. Having carried out necessary pre- and post diagnostic tests, the results show that increase in exchange ratevolatility significantly decreased gross domestic product by about 0.003 per cent on average per annum. There is further evidence of short run and long run significant positive effect of exchange rate volatility on trade openness. Although EXV has both negative and positive relationship with FDI in the long run and short run respectively, its effect was considered insignificant. Similarly, EXV has insignificant positive effect on inflation rate. Lastly, while there is evidence of short run unidirectional causality from EXV to GDP and TOP respectively, the study found cases of independence between EXV and FDI on one hand and EXV and INF on the other hand. Above key findings led to the study’s conclusion, among other things, that exchange rate volatility is one of the major determinants of gross domestic product growth in Nigeria. As such, it was recommended that adequate effort should be made to minimize fluctuation in exchange rate through necessary fiscal and monetary policy as well as close monitoring of key players in the foreign exchange market

ECONOMETRICS PROJECT TOPICS AND MATERIALS

CHAPTER ONE INTRODUCTION

1.1 Background of the Study

Exchange rate is the price of one country’s currency in relation to another country`s currency. It is the ratio between a unit of one currency and the amount of another currency for which that unit can be exchanged at a particulartime.Exchange rate is a key macroeconomic measure in the context of general economic reform programmes and its management has been a contemporary issue among academics and policy makers in recent time. For instance, the relationship between exchange rate and economic growth is of a crucial issue from both descriptive and policy perspectives. It is therefore not surprising that exchange rate is among the most watched, analyzed and government manipulated macroeconomic variable.

The extent to which exchange rate is managed can affect the growth and development of such country. As succinctly stated by Edwards (1994),it is not an understatement to postulate that the behaviour of exchange rate occupies an important position in government policy evaluation and design. Aron, Elbadawi and Kahn (2002)expressed that exchange rate has direct influence on employment, trade flow, balance of payments and the arrangement of production and consumption. On the other hand, exchange rate is an important determinant of the growth of cross-border trading of a country and it serves as a measure of its international competitiveness.

One of the most important aspects of currency exchange rates is the fluctuation in the value of a currency with respect to another. The value of a given currency rises and falls with supply and demand of that currency, which in turn, determines the exchange rate.Exchange rate movements have been a big concern for the public sector, foreign investors and private individuals since the collapse of the Bretton Woods system. In Nigeria, this system was replaced by a flexible exchange rates systemwith the introduction of the Structural Adjustment Progra-mme (SAP) of 1986in which the price of currencies was determined by the supply and demand of money. Thus, this led to the devaluation of naira and a free fall of naira against the United State dollar. Given the frequent changes of supply and demand influenced by numerous external factors, this new system increased the currency fluctuations (Grier & Mark, 2010).

According to Jhigan (2005), the variables that influence the exchange rate includes country’s exports, imports and structural influences. If country’s exports exceed imports, the demand for its currency rises and consequently, it has a positive impact on the exchange rate. On the other hand, if imports exceed exports, the desire for foreign currency rises and hence, exchange rate for such country move-up. Undoubtedly, any measure that tends to increase the volume of exports more than the rate of import, will definitely raise the value of the domestic currency against other foreign currencies. Moreover, economies are getting more open with international tradingconstantly increasing and as a result, nations become more exposed to exchange rate fluctuations. Exchange rate volatility is the sensitivity of changes in the real domestic currency value of assets, liabilities or operating incomes to unanticipated changes in exchange rate (Dufour, 2010).

Fluctuations in exchange rates may have an adverse effect on macroeconomic variables such as inflation rate, unemployment, trade openness,economic growth rate, foreign direct investment (FDI) etc.Exchange rate uncertainty affects FDI through the channel that depreciation of the currency of host country against the home currency raises the relative wealth of foreigners thereby increasing the attractiveness of the host country for FDI as firms are able to acquire assets in the host country relatively cheaply. Thus a depreciation of the host currency should increase FDI in the host country, and conversely an appreciation of the host country’s currency should decrease FDI (Ullah, Haider & Azim, 2012).

Moreover, Exchange rate movements can influence domestic prices via their effects on aggregate supply and demand. On the supply side, exchange rates could affect prices paid by the domestic buyers of imported goods directly. In an open small economy (an international price taker), when the currency depreciates it will result in higher import prices and vice versa. Exchange rate fluctuations could have an indirect supply effect on domestic prices. The potentially higher cost of imported inputs associated with an exchange rate depreciation increases marginal cost and leads to higher prices of domestically produced goods (Hyder& Shah, 2004). Furthermore, import-competing firms might increase prices in response to an increase in foreign competitor price in order to improve profit margins. The extent of such price adjustment depends on a variety of factors such as market structure, nature of government exchange rate policy, or product substitutability. Exchange rate variations can also affect aggregate demand. To a certain extent, exchange rate depreciate or appreciate foreign demand for domestic goods and services, causing increase or decrease in net exports and hence aggregate demand which may increase real output (Hyder & Shah, 2004). Furthermore, the expansion in domestic demand and gross national product may increase input prices and accelerate wage demands by workers seeking higher wages to maintain real wages. The nominal wage rise may result in further price increases.

There had been series of exchange rate policy reform by successive Nigerian government to promote macroeconomic stability and export growth. However, the effectiveness of these policies in achieving macroeconomic stability is questionable. The Nigeria exchange rate control Act was enacted in 1962. Though, the exchange rate system was in operation even before the establishment of the Central Bank of Nigeria in 1958. Before the enactment of exchange rate control Act of 1962 the foreign exchange earned by private sector were held in commercial banks abroad. These commercial banks acted as agents for local exporters. However, due to the shortage in supply of foreign exchange between 1970 and 1980`s prompted the monetary authorities to initiate adequate measure in controlling the excessive demand of foreign exchange. Furthermore, a fixed exchange rate and a comprehensive exchange rate control were adopted in 1982. But the fixed exchange rate system was abandoned in September 26, 1986. This was because of the inability of the monetary authority to effectively control the increasing demand for foreign exchange to achieve internal balance.

The flexible and managed float regime was instigated in 1986 under the Structural Adjustment Programme (SAP). This policy allowed exchange rate to float freely and to be determined by market forces. The monetary authorities were intervening intermittently in the Foreign Exchange (FOREX) market to ensure stability of the rate. Also foreign exchange market (FEM) was adopted in 1987 to ensure favorable external balance and to preserve the value of domestic currency. This led to the establishment of Bureau de change in 1989 with the aim of enlarging the scope of FEM. The above policies could not resolve the high pressure on the foreign exchange market. This led to another policy reversal in 1994 which encompassed the formal pegging of the Naira exchange rate, the centralization of foreign exchange in Central bank of Nigeria (CBN) and the restriction of Bureau de change to buy foreign exchange as an agent of CBN.

In addition, the monetary authorities went further to introduce a guided deregulation policy in 1995 that led to establishment of Autonomous Foreign Exchange Market (AFEM). AFEM was later transformed into Inter Bank Foreign Exchange Market (IFEM) in 1999. The guided deregulation policy also failed and this led to the introduction of Dutch Auction System in 2002. The Dutch auction system was introduced to solve the problem of persistent increase in demand for foreign exchange and relentless depletion of the country`s external reverses (Obadan, 2006). Also in May 2016 the monetary authorities reintroduced a flexible exchange rate where exchange rate is allowed to be determined by demand and supply of foreign currency. This development was as a result of the failure of fixed exchange to address foreign exchange rate problem. Even the recent adopted flexible exchange policy have worsen the Nigeria economy as foreign exchange rate continues to fluctuates on daily bases and prices of goods continues to inflate on a high rate.

There is an argument by some economists that the above depreciation is attributed to the decline in the nation’s foreign exchange reserves, fragile export and weak production base. In contrast others are of the veiw that the recent decline in naira is attributed to the activities of speculators and banks. These practices have led to the fluctuation and misalignment in the real exchange rate. Thus, there is need to examine the impact of exchange rate volatility on some selected macroeconomic variable.

Statement of the problem

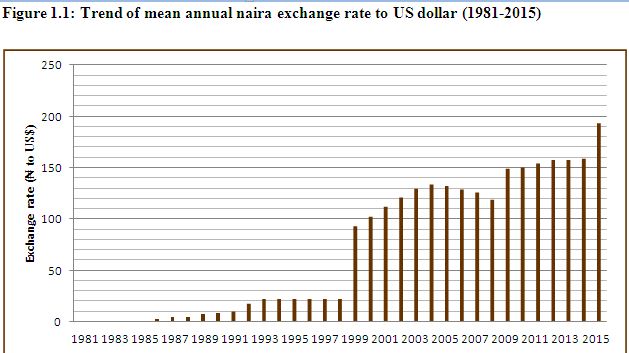

The effect of exchange rate volatility on macroeconomic variables in Nigeria is a major issue. There is a general consensus that exchange rate volatility causes problems for aggregate economic performance.However there is less agreement on the relationship between exchange rate volatility, economic growth and how it affects economic activities at the macroeconomic level. This has generated significant debate both theoretically and empirically. The level of the country’s exchange rate volatility is no longer the only problem, but the fact that exchange rate volatility has reached a crisis stage. Since the introduction of the Structural Adjustment Programme (SAP) of 1986, exchange rate has become so volatile in Nigeria and the recent rate of exchange rate has been a cause of great concern to many as Figure 1.1 shows.

Contents